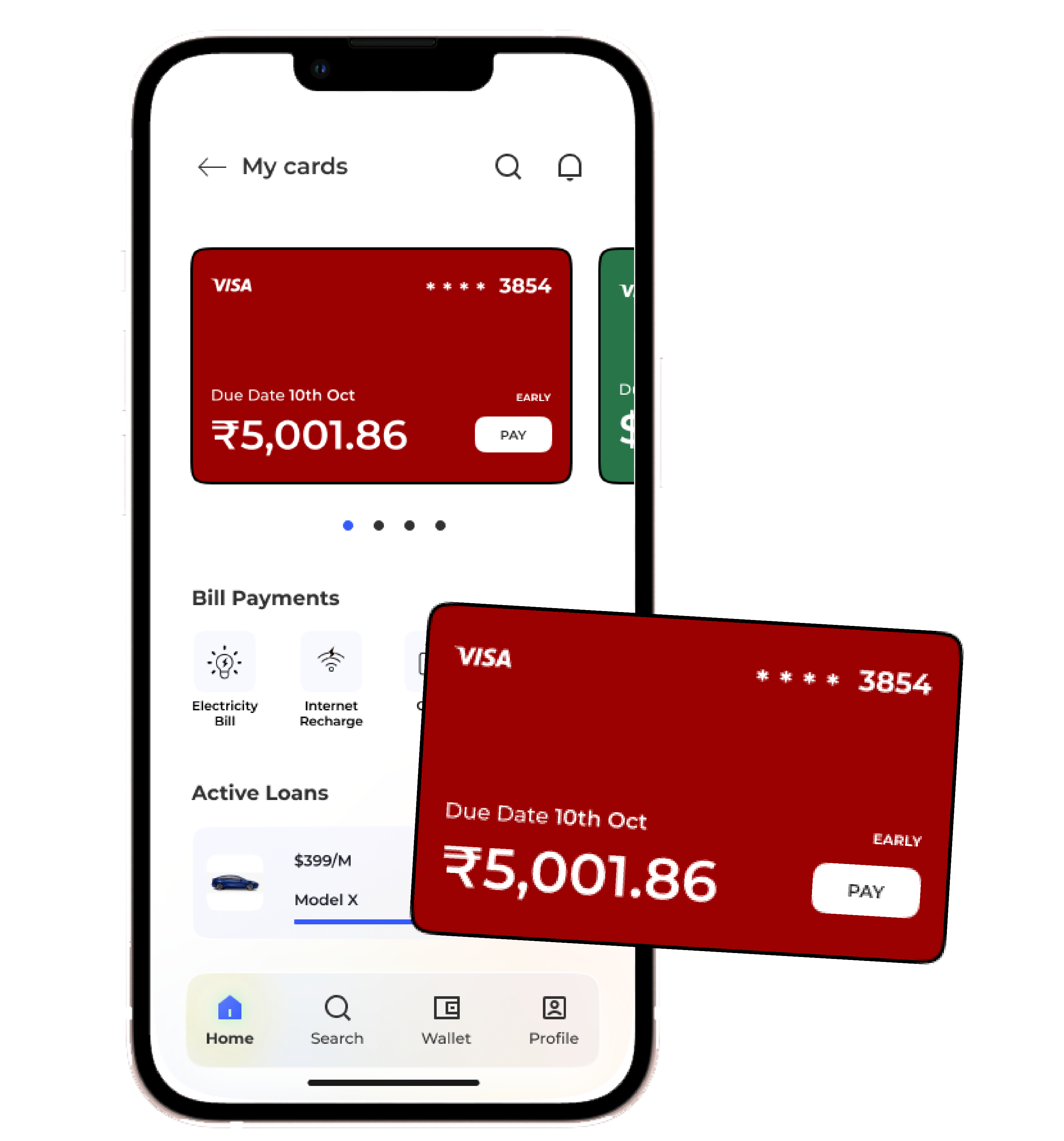

Apply for a OnlineUdhaar Credit Card in minutes using minimal documentation, and our team will do the rest.

Getting a Credit Card with OnlineUdhaar is easy. Simply complete your request and we’ll do the rest, hassle free.

A credit card is like a special tool that acts as a mini loan for buying stuff from different stores. You get to pay back what you spent later, usually after you get a bill. This way of paying works for lots of things – like covering bills, sorting out travel costs, getting new tech gadgets, and shopping on the internet or at actual stores. Credit cards give you a handy and flexible way to buy things, no matter if they're big or small. Plus, they often come with cool deals and discounts, making your shopping experience even more comfy, whether you're doing it online or in a physical store.

How we profit: Users are not charged for using our services. With OnlineUdhaar, you can apply for a loan without paying any hidden or application costs. As an alternative, we pass the cost along to lenders and potential lenders who are interested in evaluating your information on our website.

We are not a lender: OnlineUdhaar is not a lender and does not decide whether to grant credit or loans, nor does it act as a loan broker for lenders. It does not advocate any lenders, act as their agent, representative, or broker, or charge you for any services or goods. There is no loan offer or solicitation on this website. You can send the data you supply to a lender using this website. We have no influence over the lenders or lending partners in our network, and we are not liable for any of their decisions. We are not their representatives or agents. Your OnlineUdhaar loan request is not an application for a loan.

Loan offers: In order to get you the best loan deal from our network of lenders, OnlineUdhaar analyzes your loan application. OnlineUdhaar does not have access to all lenders or loan products, despite the size of our network. As a result, the offer you receive through OnlineUdhaar may not necessarily be your best choice. In order to choose the best course of action for your particular scenario, you need analyze all of the offerings from various platforms.

Illustrative example: Your monthly installments will be 131.67 if you borrow 5,000 over a 48-month period with an 8% arrangement charge (or $400). Your total payback amount will be $6,320.12, which includes the 8% arrangement fee for a total cost of $1,720.12. This is an APR of 18.23%.

APR & Interest rates:The APR can range from 5.99% to 35.99%. OnlineUdhaar has no control over the actual APR offered to you by the lenders. The APR offered to you is dependent on various factors like loan amount, tenure, credit score, and interest rate. The minimum tenure for a loan is 61 days.

Availability of services: Even though OnlineUdhaar offers a wide network of lenders, not all of them could be available where you are. certain lenders decide not to provide services to certain places based on their own regulations.

Credit score: Lenders use credit ratings to measure your capacity to manage finances and repay loans. Credit bureaus such as CIBIL determine your credit score by considering characteristics such as income, debt, and credit history. Your credit score may influence the loan possibilities and interest rates that lenders give you.

Loan guarantee:The completion of an Onlineudhaar loan application does not guarantee loan acceptance. Lenders evaluate your application to establish loan eligibility and loan amount eligibility. While OnlineUdhaar makes every effort to complete loan applications within 24 hours, cash may take longer to transfer in rare cases. Before making financial decisions, users should conduct due diligence and investigation on the material offered on this site.